How to Protect Your Tg Wallet from Fraud

페이지 정보

작성자 agilimo 작성일24-11-26 20:45 조회2,167회 댓글0건관련링크

본문

In today’s fast-paced digital world, managing finances has become simpler and more efficient thanks to innovative technological solutions. Tools that facilitate automatic transactions, offer real-time updates, and ensure secure management of funds are increasingly becoming essential in our daily lives. These advancements not only make financial tasks easier but also bring a new level of convenience and control to users.

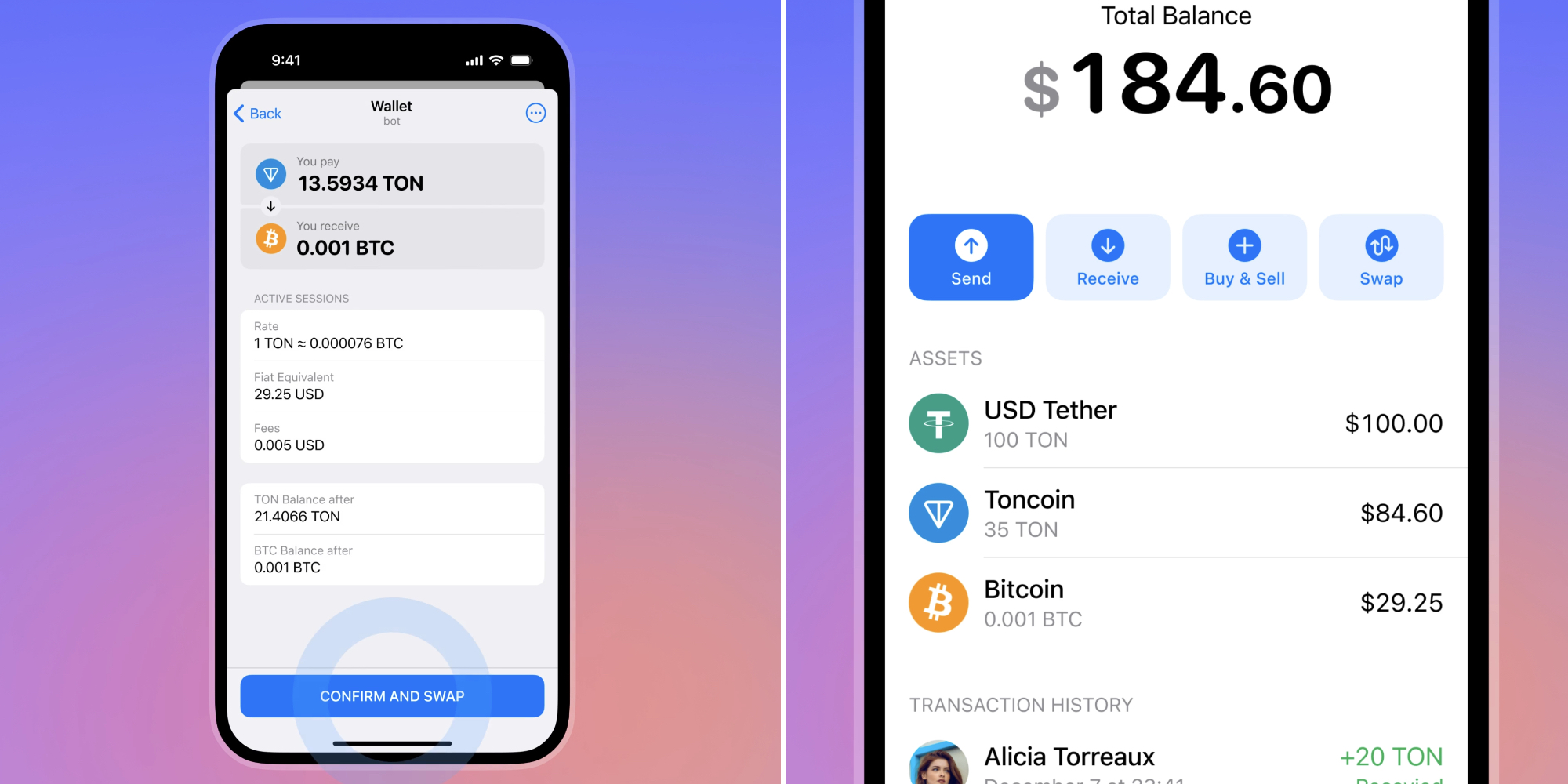

Through seamless integration of digital assistants, individuals can now manage their financial activities effortlessly. From keeping track of balances to executing transactions, these systems operate autonomously, providing users with a streamlined experience. This integration ensures that personal finances are organized and managed efficiently, without the need for constant intervention tg wallet.

Such solutions are pushing the boundaries of traditional financial management, empowering users to make smarter decisions. By eliminating manual tasks and introducing automation, they help optimize financial workflows, enhance security, and minimize errors, making the management of funds more accessible to everyone.

Automating Financial Transactions for Efficiency

Automation has become a cornerstone of modern financial management, bringing speed and precision to everyday transactions. By removing the need for manual intervention, financial tasks are executed swiftly and accurately, ensuring that users can save time and avoid errors. With the right tools in place, even complex financial processes can be managed with minimal effort, all while maintaining the highest standards of security.

Automated systems are now capable of handling a variety of tasks, from transferring funds to monitoring balances. This enables users to stay up-to-date with their financial status at all times, without having to manually check or update their accounts. The technology not only streamlines routine tasks but also allows for more advanced features, such as setting up automatic payments and tracking expenditure trends.

With these innovations, individuals and businesses alike can experience a new level of efficiency in managing their finances. Automation not only saves time but also reduces the risk of human error, offering a more reliable and consistent way to handle transactions. As these tools continue to evolve, they will play an increasingly important role in reshaping how we approach financial management.

Enhancing User Experience with Digital Tools

Digital tools have revolutionized the way users interact with their financial activities, providing seamless access to various services. These innovations offer a more intuitive and efficient experience, allowing users to manage their finances with ease and confidence. By integrating advanced technologies, such as automated systems and user-friendly interfaces, these tools ensure that tasks are completed faster and more accurately, reducing complexity and increasing satisfaction.

With the rise of digital solutions, individuals now have the ability to manage their accounts, monitor transactions, and make transfers at the touch of a button. These tools are designed to be simple yet powerful, catering to both novice and experienced users. Whether it's tracking spending habits or setting up alerts for important transactions, digital tools offer a personalized experience that enhances convenience and control.

Moreover, the continuous improvement of these platforms ensures that users can always expect better performance and additional features. From security enhancements to intuitive designs, the goal is to create an environment where users can feel empowered and in control of their financial decisions, without the stress of complicated processes.

댓글목록

등록된 댓글이 없습니다.