The Pros and Cons of Tg Wallet for Online Shopping

페이지 정보

작성자 utuwij 작성일24-11-25 23:51 조회1,746회 댓글2건관련링크

본문

The digital economy has rapidly transformed the way we handle financial transactions, creating opportunities for more efficient and secure systems. With the growing use of virtual currencies, managing assets online has become an essential aspect of modern financial interactions.

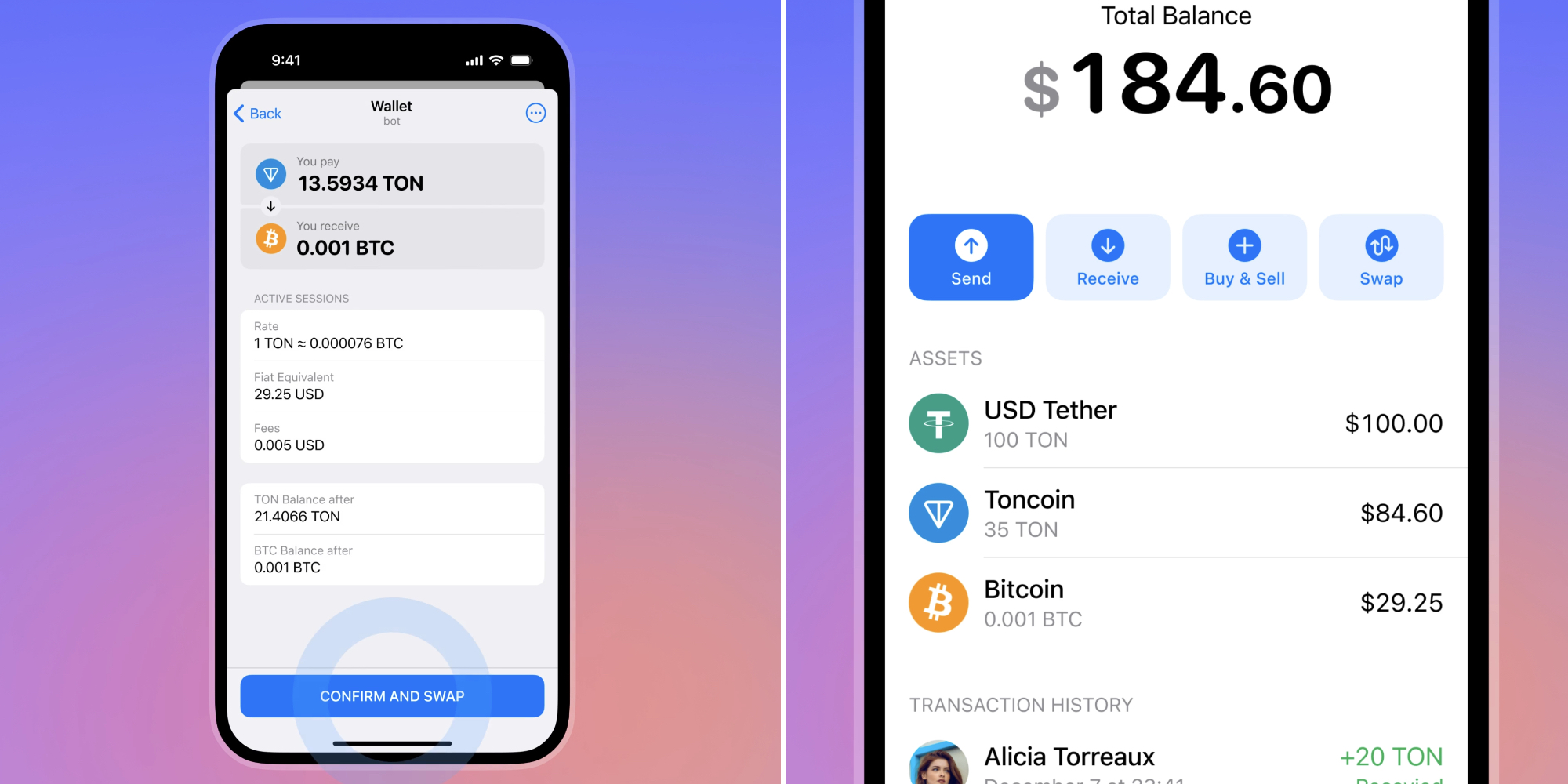

Smart technology is at the forefront of this transformation, enabling users to carry out complex financial tasks seamlessly. From sending payments to tracking balances, these tools simplify the management of digital funds and offer improved security features to protect sensitive information tg wallet.

Automation plays a key role in streamlining transactions, reducing manual involvement and enhancing user experience. The integration of these systems not only makes digital finance more accessible but also paves the way for innovative solutions in asset management, all while maintaining high levels of convenience and safety.

Transforming Digital Finance Management

The landscape of financial management has been dramatically reshaped with the advent of new technologies, providing users with greater flexibility and efficiency in handling their virtual assets. As traditional systems become outdated, innovative solutions are rising to meet the growing demand for seamless, secure, and easily accessible financial services.

One of the most significant advancements is the ability to manage financial transactions and assets through digital interfaces. These platforms offer a more streamlined approach to tracking, sending, and receiving funds, minimizing the complexities often associated with conventional methods. Users are now able to perform a wide range of financial operations from a single, integrated platform.

Furthermore, these systems enable automation of various financial tasks, eliminating the need for manual input. This not only saves time but also ensures that transactions are carried out more accurately and securely. As a result, digital finance management has evolved to offer a more user-friendly and efficient experience, while addressing the growing need for security and privacy in an increasingly connected world.

Improving User Experience in Virtual Transactions

As digital finance continues to evolve, enhancing the user experience during virtual transactions has become a key priority. Modern solutions are designed to make interactions smoother, faster, and more intuitive, ensuring that users can engage with their digital assets without unnecessary complexities. These advancements focus on simplifying processes and making the management of virtual transactions as seamless as possible.

To achieve this, systems are incorporating features that minimize the effort required from users. Automated processes, real-time updates, and easily navigable interfaces have been introduced to provide a hassle-free experience. This means users can quickly complete their transactions with confidence, knowing that their actions are secure and straightforward.

Moreover, the integration of advanced security measures plays a crucial role in improving trust and confidence. With encryption, two-factor authentication, and other security protocols, users can feel assured that their financial activities are protected. This approach not only boosts usability but also contributes to the overall satisfaction of those engaging in digital financial transactions.

댓글목록

Sang님의 댓글

Sang 작성일That is a very good tip particularly to those new to the blogosphere. Brief but very precise information… Appreciate your sharing this one. A must read post! https://flystarlady.listbb.ru/viewtopic.php?f=29&t=6306

Milagro Dubay님의 댓글

Milagro Dubay 작성일I have read so many content on the topic of the blogger lovers but this piece of writing is really a pleasant article, keep it up. https://skladchik.tv/forums/floristika.38/